For Landlords & Investors

A Capital Improvement

That Generates Returns.

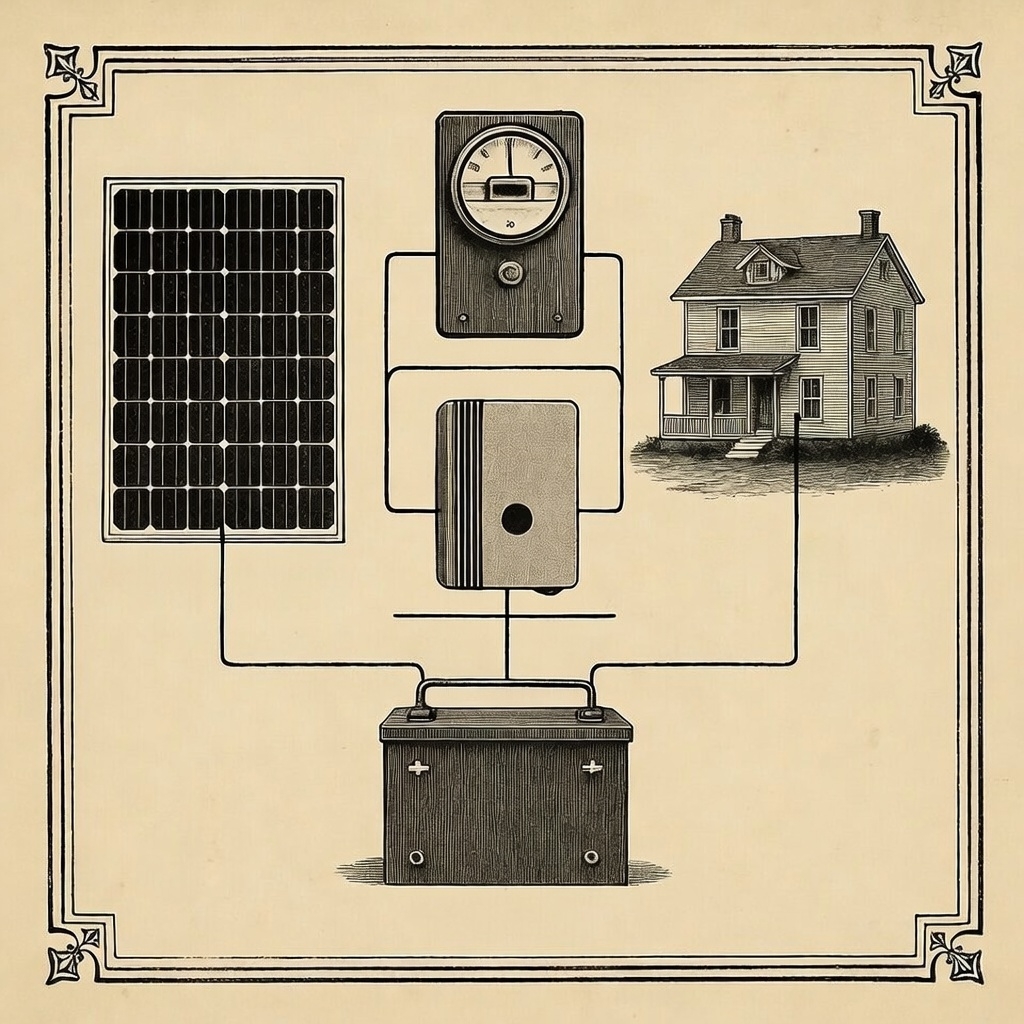

Optimize your assets. Predictable operating costs. Differentiate your properties. Battery-backed solar, modeled at the individual property level for investors who make decisions based on numbers.

Assess Your PropertiesThe Investment Case

Solar as a Portfolio Strategy

For property investors, solar is a capital improvement with quantifiable returns — not a lifestyle decision. We model each property individually because blanket approaches waste money. Some buildings in your portfolio are excellent solar candidates. Others aren't. We'll tell you which is which, and show you why.

The calculation is straightforward: installation cost vs. decades of predictable operating costs, increased property value, and competitive differentiation in your rental market.

Financial Impact

Three Ways Solar Improves Your Portfolio

Predictable Operating Costs

Battery-backed solar locks in a portion of your energy costs at a fixed rate. Common-area power and tenant-facing loads draw from on-site production and storage. As utility prices climb year over year, your rate protection compounds.

Increase Property Value

Solar + battery installations are capitalized improvements that add directly to assessed property value. For income properties, predictable operating costs also support net operating income — which improves your cap rate.

Differentiate Your Rentals

Properties with battery-backed solar and backup power stand out in competitive rental markets. Tenants increasingly recognize the value of backup power during outages and predictable power costs — it's a practical amenity, not a marketing gimmick.

What You Should Know

Portfolio Considerations

We think through the complexity so you don't have to. Here are the factors we evaluate for every property.

Utility Structure Matters

How your properties are metered — individually, master-metered, or common-area only — fundamentally changes the solar math. We model the actual utility structure of each property, not assumptions.

Not Every Property Is a Candidate

Roof condition, orientation, shading, and structural capacity all determine viability. We'll assess your properties honestly and tell you which ones don't make sense — before you spend money on them.

Tenant Turnover & Management

We help you think through how solar integrates with your tenant structure: who benefits from production, how billing works during vacancies, and what (if anything) changes in your lease agreements.

Multi-Property Timelines

If multiple properties are viable, we can phase installations to align with your capital planning. Not everything needs to happen at once — we help you prioritize by ROI and logistical readiness.

Insurance & Liability

Solar installations are covered under standard commercial property insurance in most cases. We provide all documentation your insurer needs and walk you through any policy adjustments required.

The Process

How It Works for Investors

Property Assessment

Enter each property address in our quote tool for per-property ballpark estimates. No personal info required — just addresses and approximate numbers.

Inspection

Book professional site assessments at $200 per property. An engineer evaluates each building individually — roof, shading, electrical, structural. Fee credited toward installation.

Financial Modeling & Proposal

Per-property precise quotes with three product tiers each. Portfolio-level strategy and phased timelines for multi-property rollouts. Real numbers, not blanket estimates.

Phased Installation

Prioritized by ROI and property readiness. Permits, inspections, and coordination handled by us. If we're more than a month late, we cover your utility bill until we're done.

Common Questions